Sustainability is becoming increasingly prominent in today’s business environment. Investors, consumers, and regulators are demanding greater transparency about the environmental, social, and governance (ESG) impact of companies. In response, the European Union has implemented the Corporate Sustainability Reporting Directive (CSRD), aimed at improving the quality and comparability of sustainability reports. But what exactly is the CSRD, and what does it demand from companies?

What is the CSRD?

The Corporate Sustainability Reporting Directive (CSRD) is a regulation published by the European Union in 2022, which replaces the Non-Financial Reporting Directive (NFRD). The CSRD requires companies to provide more detailed and standardized information about their impact on environmental, social, and governance (ESG) factors, aiming to increase transparency and the reliability of sustainability reports.

This directive affects not only large listed companies but also extends to other firms previously not required to report, such as medium-sized companies and some SMEs, representing a significant shift from previous regulations.

Why did the CSRD emerge?

The CSRD was introduced in response to growing concerns about climate change, sustainability, and the need for greater oversight of responsible business practices. Its goal is to ensure companies provide reliable ESG data that investors, consumers, and other stakeholders can use to make informed decisions.

This focus on transparency also seeks to combat greenwashing, where companies exaggerate or falsely claim their commitment to sustainability. In this way, the CSRD helps ensure that businesses report accurately on their real impact.

Which companies are affected by the CSRD?

Unlike the previous NFRD, the CSRD will apply to a much larger number of companies, both large and medium-sized. It is estimated that over 50,000 companies across the European Union will be required to comply with the CSRD, compared to the 11,600 under the NFRD.

The types of companies required to comply with the CSRD include:

- From January 2024: Large listed companies and parent companies of listed groups with an average of more than 500 employees during the fiscal year.

- From January 2025: Large companies and parent companies of large groups, even if not listed, must comply.

- From January 2026: SMEs listed on an EU-regulated market, excluding micro-enterprises, will need to comply, with an optional delay until January 2028.

What are the requirements of the CSRD?

The CSRD mandates that companies prepare detailed reports on a wide range of sustainability-related topics, including:

- Environmental information: Climate impact, use of natural resources, pollution, biodiversity, and circular economy.

- Social information: Human rights, labor conditions, gender equality, diversity, and relationships with local communities.

- Governance: Company governance structure, anti-corruption practices, and ESG risk management.

- Long-term impact: Companies must also provide data on how their current activities will affect their long-term sustainability performance.

These reports must not only include assessments of the company’s impact but also how the company is affected by external issues like climate change or human rights.

Standardization of reports: the key to CSRD

One of the most important aspects of the CSRD is the creation of a standardized framework for sustainability reports. The European Financial Reporting Advisory Group (EFRAG) has been tasked with developing the European Sustainability Reporting Standards (ESRS), known in Spain as NEIS (Normas Europeas de Información sobre Sostenibilidad), which define the criteria companies must meet for their reports to be comparable and verifiable.

Standardization not only facilitates comparability between companies but also boosts the confidence of investors and other stakeholders in sustainability reports.

How does the CSRD affect companies?

The CSRD presents both challenges and opportunities for companies. The main challenges include:

- Increased complexity: Companies must collect and report more detailed information across a broader range of ESG indicators.

- External verification: Reports must be verified by external auditors, adding an additional layer of control.

- Initial costs: Implementing the necessary systems to comply with the CSRD requirements may involve considerable investment.

However, it also represents an opportunity for companies to enhance their reputation and credibility with stakeholders. Companies already making progress in sustainability will stand out from the competition.

What should companies do to prepare for the CSRD?

To comply with the CSRD requirements, companies should begin preparations as soon as possible. Key actions include:

- Assess the current state of their ESG reports: Identify areas where data collection and impact communication need improvement.

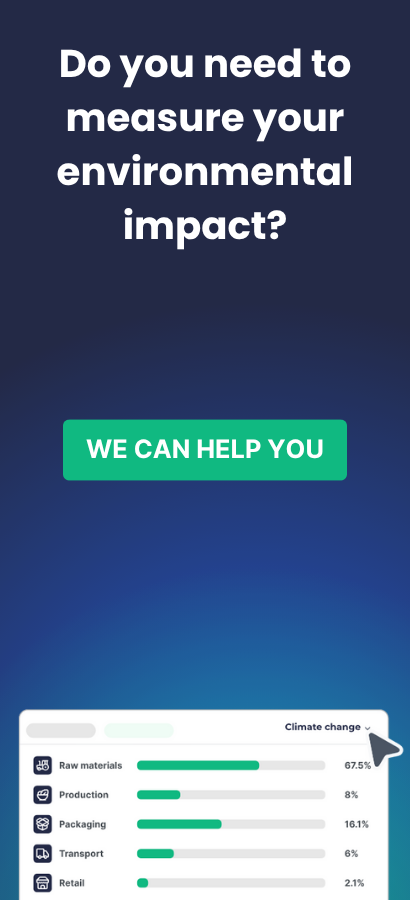

- Implement technological tools: Data management systems that facilitate the collection and analysis of ESG indicators. Tools like lifecycle analysis (LCA) or sustainability software will be crucial.

- Train the team: The sustainability and accounting departments should be familiar with the new standards and requirements.

- Collaborate with suppliers: Transparency in the supply chain is key to meeting CSRD standards.

Conclusion

The implementation of the CSRD marks a significant change in how companies must manage and report their ESG impact. Although it presents challenges, such as detailed data collection and external verification, it also opens opportunities for companies wanting to differentiate themselves through their commitment to sustainability. Proactively preparing will be essential to comply with this new regulation and leverage its benefits.