Introduction

ESG approval in the supply chain is a crucial process to ensure regulatory compliance and enhance corporate sustainability. In the webinar organized by the Club of Responsible and Sustainable Companies, Pablo Rodríguez Juan, CEO of Trazable, and Eva Núñez, director of S3C Triple Impact, explained how companies can implement ESG approval processes aligned with current regulations and industry best practices.

This article summarizes the key points from the webinar and provides a detailed methodology for evaluating and managing suppliers based on ESG criteria.

1. What is ESG approval, and why is it key in the supply chain?

ESG approval allows companies to evaluate their suppliers based on environmental, social, and governance criteria, ensuring compliance with international regulations and standards.

Key points covered in the webinar:

- Evolution of the supplier approval process.

- Application of ESG criteria in industries such as textiles and food.

- Importance of compliance with regulations like CSRD (Corporate Sustainability Reporting Directive), CS3D (Corporate Sustainability Due Diligence Directive), and EUDR (European Union Deforestation Regulation).

ESG approval not only ensures regulatory compliance but also mitigates financial risks and enhances competitiveness.

2. Benefits and risks of ESG approval

Companies that implement ESG approval processes can:

Benefits:

✔ Reduce the risk of fines and lawsuits.

✔ Ensure access to major distributors that require ESG standards.

✔ Gain advantages in sustainable financing.

✔ Build a strong corporate reputation.

Risks of not implementing ESG approval:

❌ Loss of contracts with clients demanding ESG compliance.

❌ Fines for regulatory non-compliance.

❌ Difficulty accessing investors and green financing.

According to Pablo Rodríguez Juan, CEO of Trazable, a real-life case highlights the importance of anticipation:

“A cocoa supplier working with Carrefour lacked fair trade certifications and lost its client when new ESG standards were required in the supply chain.”

Avoid these risks with an effective ESG approval strategy.

3. How to implement ESG approval in your company

Step 1: ESG Maturity Assessment

- Diagnose internal ESG knowledge and control.

- Identify the level of sustainability integration into the company’s strategy.

Step 2: Defining ESG Criteria for Supplier Approval

- Environmental: Carbon footprint (GHG Protocol, ISO 14064), resource efficiency.

- Social: Labor rights, community impact, human rights due diligence (CS3D).

- Governance: Transparency, regulatory compliance, ethical code.

Step 3: Supplier Data Collection and Validation

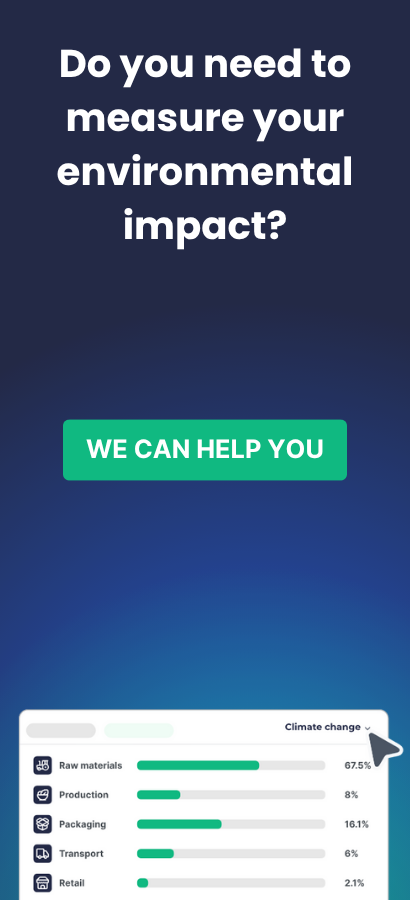

- Implement ESG approval and traceability software like Trazable Lifecycle.

- Use official reference sources: DEFRA, IPCC, ecoinvent, MITECO.

- Key certifications: EcoVadis, B Corp, SEDEX, SMETA.

Step 4: Integration into Corporate Strategy

- Define ESG goals aligned with the 2030 Agenda.

- Sustainability reporting using ESRS (European Sustainability Reporting Standards) and GRI (Global Reporting Initiative).

- Communicate sustainability progress to investors and clients.

4. Practical cases and digital tools for ESG approval

Example 1: Compliance with the EU Deforestation Regulation (EUDR)

Companies working with products like cocoa, coffee, or palm oil must ensure their origin through geolocation and document traceability.

Example 2: Measuring Scope 3 Carbon Footprint

According to Eva Núñez, many companies underestimate their Scope 3 impact:

“Estimates based on statistical data can vary by 50% compared to actual supplier data. To reduce carbon offset costs, improving measurement accuracy is essential.”

Example 3: ESG Approval Digitalization

Platforms like Trazable Lifecycle allow companies to centralize supplier data and automate ESG reporting, simplifying regulatory compliance.

Conclusions and next Steps

Companies that implement ESG approval not only comply with regulations but also strengthen their market positioning and mitigate financial and reputational risks.

Final recommendations:

✔ Define a strategic ESG plan with clear metrics.

✔ Establish partnerships with suppliers to improve traceability and data collection.

✔ Digitize ESG management to facilitate audits and sustainability reports.

Regulations will continue to evolve, and companies that adapt quickly will gain a competitive edge. Don’t wait until it becomes mandatory—start working on ESG approval now.