ESG (Environmental, Social, and Governance) reports are essential tools for companies to communicate their sustainability performance to key stakeholders, including investors, clients, and regulators. Preparing a comprehensive, clear, and internationally compliant ESG report requires the inclusion of fundamental elements that ensure its relevance and credibility. In this article, we explore the essential components that must be included in your ESG report to follow best practices and build trust in your organization.

1. Statement of commitment

The report should begin with an introductory letter or statement from the CEO or a member of the executive committee, highlighting:

- The importance of sustainability to the company.

- The main ESG achievements during the reporting period.

- Future commitments and strategic goals.

Example: “We are committed to reducing our carbon footprint by 50% by 2030, aligned with the Paris Agreement objectives.”

2. Company overview

Provide an overview of the organization, including:

- Mission, vision, and values: Emphasize how sustainability is integrated into your corporate culture.

- Scope of the report: Specify which areas or entities of the company are covered in the analysis.

- Key data: Number of employees, operational locations, industries served, etc.

3. Materiality analysis

A materiality analysis identifies the most relevant ESG topics for your company and stakeholders. Include:

- Analysis results: A materiality matrix showing the priority of each topic based on its impact and relevance.

- Methodology used: Explain how the analysis was conducted (surveys, interviews, historical data).

4. Environmental performance (E)

Environmental indicators are essential for measuring and reporting the company’s impact on the environment. Include:

- Carbon emissions: Data for Scope 1, Scope 2, and, if possible, Scope 3.

- Energy consumption: Renewable vs. non-renewable energy sources.

- Water management: Usage, recycling, and reduction of water in operational processes.

- Waste management: Generation, recycling, and disposal of waste.

- Biodiversity: Impact on local ecosystems or conservation measures.

- Relevant standards: GHG Protocol, ISO 14001.

5. Social performance (S)

The social component evaluates how the company interacts with employees, communities, and other stakeholders. Be sure to include:

- Diversity and inclusion: Gender ratios, pay equity, and inclusion programs.

- Labor conditions: Workplace safety, training, and employee benefits.

- Community relations: Social projects, investments in education or health, and local collaborations.

- Human rights: Policies and measures to prevent abuses in the supply chain.

- Relevant standards: Equality plans, SA8000.

6. Governance performance (G)

This section focuses on how the company is managed ethically and transparently. Include:

- Governance structure: Composition of the board of directors, diversity policies, and member expertise.

- Business ethics: Anti-corruption policies, regulatory compliance, and conflict-of-interest management.

- Risk management: Evaluation and mitigation of ESG risks in operations and the supply chain.

- Data protection: Compliance with privacy regulations such as GDPR.

- Relevant standards: ISO 37001 (anti-corruption).

7. Objectives and key performance indicators (KPIs)

Define clear metrics to evaluate your sustainability progress. Examples of KPIs:

- Reduction of carbon emissions (in tons) during period X compared to period Y.

- Percentage of renewable energy used in facilities X compared to total energy consumed at those sites.

- Increase in gender diversity in leadership positions over years X.

- Reduction of landfill waste in facilities or processes compared to the previous year’s baseline.

KPIs should be SMART (specific, measurable, achievable, relevant, and time-bound).

8. Regulatory frameworks and standards used

Specify the international standards or regulations guiding your ESG report. Examples:

- GRI (Global Reporting Initiative): For comprehensive impact reporting.

- SASB (Sustainability Accounting Standards Board): For sector-specific financial indicators.

- CSRD (Corporate Sustainability Reporting Directive): Mandatory reporting progressively enforced in Europe.

Referencing these ensures global recognition and comparability of the report.

9. Auditing and certifications

If the report has been externally audited, highlight this aspect to strengthen its credibility. Include:

- The name of the verifying entity.

- Scope and methodology of the audit.

- Certifications obtained (ISO 14001, B Corp, etc.).

10. Future outlook

Dedicate a section of the report to future sustainability goals and plans. This can include:

- Short, medium, and long-term goals.

- Planned technological innovations.

- Strategic sustainability collaborations or partnerships.

11. Appendices and additional transparency

Include appendices to provide detailed information and additional resources, such as:

- A glossary of technical terms.

- Extended data tables.

- Calculation methodologies used.

- Cross-references between the applied standards.

- Table of contents.

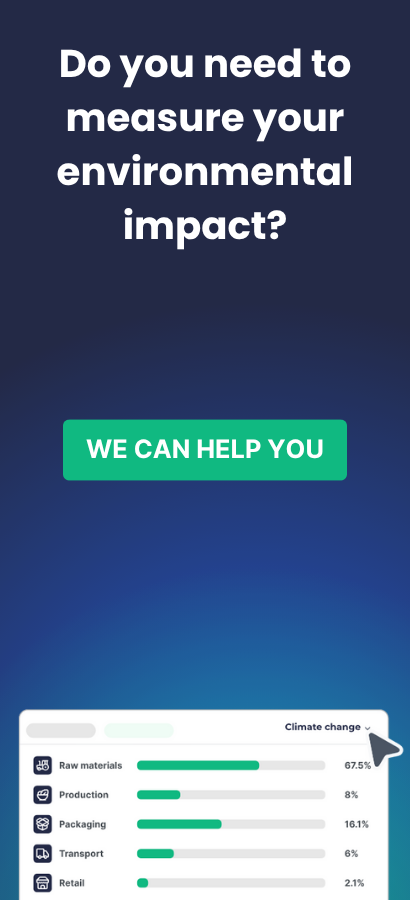

12. Visual design and communication impact

An ESG report should be accessible and visually appealing. Use:

- Charts and tables: To clearly represent metrics.

- Impact stories: Narrative examples showcasing how the company’s actions have led to positive changes.

- Infographics: Visual summaries of key results.

Conclusion

A well-crafted ESG report not only meets regulatory requirements but also strengthens the company’s reputation and builds trust among stakeholders. Including these key elements ensures your report is comprehensive, transparent, and aligned with global best practices.