Preparing sustainability reports or ESG (Environmental, Social, and Governance) reports is crucial for companies seeking to demonstrate their commitment to sustainability. For some, it’s even mandatory, such as those that need to comply with regulations like Law 11/2018 on Non-Financial Information Disclosures or the upcoming Corporate Sustainability Reporting Directive (CSRD) in Europe. However, many companies make common mistakes when preparing these reports, which can affect the credibility of the information presented and risk regulatory compliance.

In this article, we’ll show you the 5 most common mistakes in preparing ESG reports and how to avoid them to ensure your company meets standards and expectations.

1. Collecting incomplete or incorrect data

One of the most frequent mistakes is failing to have complete data or using incorrect information for ESG reports. This can happen due to manual data collection or the lack of appropriate tools to gather accurate information.

How to avoid it:

- Implement automated systems for data collection, such as Trazable’s sustainability software, which ensures that the data collected is complete, accurate, and from verified sources.

- Ensure the data covers all three scopes in emission reports (direct, indirect, and supply chain) and includes key environmental, social, and governance indicators.

2. Not keeping up with regulatory changes

ESG regulations are constantly evolving, and failing to stay updated on regulatory changes can lead to outdated or incomplete reports. With regulations like the CSRD, which requires more data and standardization, it’s essential to stay aware of the latest requirements.

How to avoid it:

- Continuously monitor regulations that apply to your sector. The CSRD sets clear standards and requires many more companies to submit ESG reports than before.

- Work with sustainability experts or auditors who can advise you on regulatory changes and help ensure your report meets the latest standards.

3. Failing to establish clear and measurable ESG indicators

Some companies do not clearly define which ESG indicators are relevant to their sector or activity, leading to reports with no focus or metrics that are neither measurable nor comparable. Without a clear set of key performance indicators (KPIs), it’s difficult for reports to hold value for investors and other stakeholders.

How to avoid it:

- Establish clear and measurable indicators following recognized frameworks such as the GRI Standards or the European Sustainability Reporting Standards (ESRS) defined by the CSRD.

- Indicators should be relevant, such as CO2 emissions, energy consumption, workforce diversity, governance, and human rights. This will make reports more understandable and comparable over time.

4. Not verifying data or conducting audits

Presenting ESG data without verification can be a costly mistake. The lack of external audits or data verification can lead to inconsistencies, errors, and loss of trust from investors and regulators. Companies that don’t subject their reports to independent reviews risk having data that isn’t credible.

How to avoid it:

- Submit ESG data to external audits to ensure it’s verifiable and meets the accuracy requirements set by regulations like the CSRD.

- Keep a detailed record of the data collection processes and ensure that the data is traceable. This allows for easier independent reviews and ensures transparency.

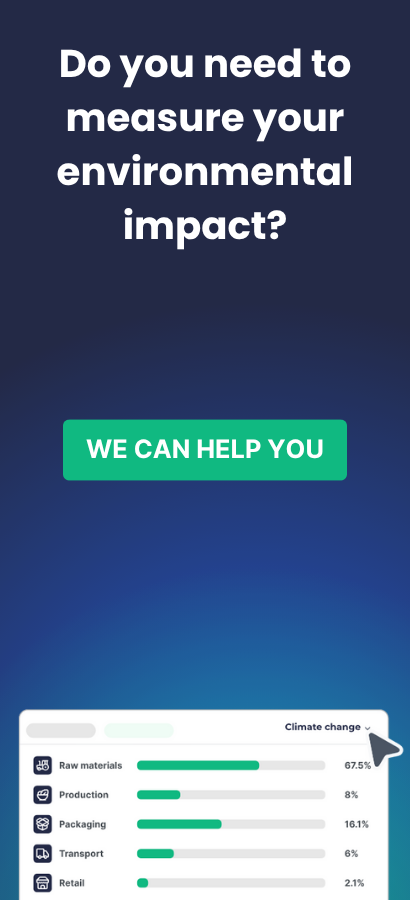

5. Underestimating the importance of the supply chain

Many companies overlook the supply chain in their ESG reports, limiting themselves to the direct impacts of their operations. This can result in an incomplete report, as many carbon emissions and other ESG impacts occur throughout the value chain. Ignoring the supply chain not only affects the report’s quality but can also lead to compliance issues.

How to avoid it:

- Ensure that your report covers Scope 1, 2, and 3 carbon emissions, which include emissions generated by suppliers and products throughout the value chain.

- Use tools like Trazable, which allows you to automatically collect ESG data from your suppliers, ensuring that reports accurately reflect the impact of the entire supply chain.

Conclusion

Preparing ESG reports can be challenging, but avoiding these common mistakes will allow you to present accurate, verifiable, and valuable reports for all stakeholders. Implementing automated systems, auditing data, and ensuring your reports cover both direct operations and the supply chain is key to a successful report.