The rise of sustainability and increasing regulatory demands, such as the Corporate Sustainability Reporting Directive (CSRD), require companies not only to collect ESG (Environmental, Social, and Governance) data but also to ensure that this data is of high quality and rigorously verified. Third-party verification is key to ensuring that sustainability reports comply with regulations and are credible to investors and stakeholders.

In this article, we explore how to ensure that ESG data is verifiable and how to meet the CSRD requirements for sustainability reporting.

Why is the verifiability of ESG data important?

Verifiability ensures that the data reported in ESG reports can be independently reviewed and validated, increasing the company’s transparency and credibility. In the context of regulations like the CSRD, ESG reports must meet certain standards to be audited by third parties, making the quality of the data crucial.

Unverifiable data can lead to incomplete or inaccurate reports, exposing companies to sanctions, reputational damage, and loss of investor trust.

5 Steps to Ensure ESG Data is Verifiable

1. Implement Automated Data Collection Systems

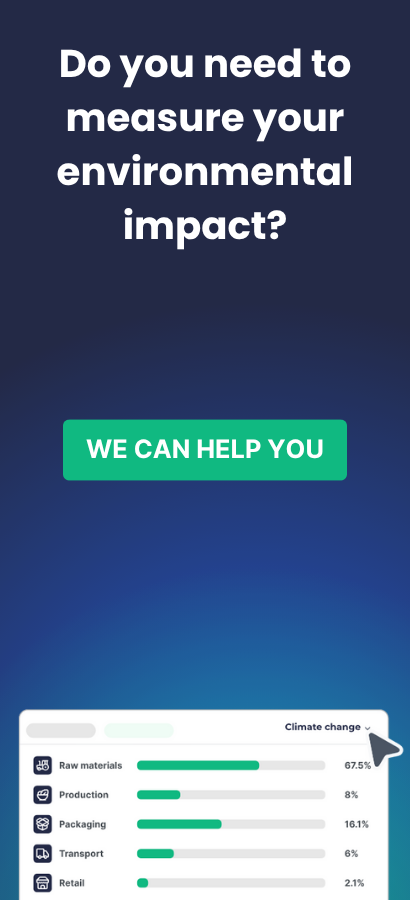

The first step to ensuring that ESG data is verifiable is to automate data collection whenever possible. Using specialized software reduces the risk of human error and facilitates the storage and organization of data over time.

Technological solutions, such as Trazable, allow for efficient data collection from multiple sources, including supply chains and internal systems. Automation ensures that data is accurate and traceable, two key qualities for verifiability.

Benefits:

- Consistent and centralized data collection.

- Reduced risk of manual errors.

- Easy access to historical data for future verifications.

2. Use Reliable Databases

To ensure the verifiability of ESG data, it is essential to use reliable and standardized data sources. The data collected must come from systems recognized and accepted by stakeholders, including external auditors.

Software tools like Simapro or OpenLCA are widely used in the industry for lifecycle analysis (LCA), and their databases help ensure that environmental data is accurate and comparable. In the case of Trazable, its database specializes in the food industry, ensuring that the data collected is specific and relevant to this sector.

3. Establish Clear and Measurable Indicators

The verifiability of data depends on the clarity of the selected ESG indicators. Data must be measurable, objective, and linked to established indicators that can be compared over time and between different companies.

Examples of key indicators include:

- Carbon footprint (tCO2e) for environmental impact.

- Training hours and employee turnover rates for social aspects.

- Governance structure and anti-corruption policies for governance.

Reports based on these indicators should follow global standards such as the Global Reporting Initiative (GRI) or the European Sustainability Reporting Standards (ESRS), known in Spain as NEIS, from the CSRD. These standards ensure that reported data is consistent and verifiable.

4. Document Data Collection and Analysis Processes

It is crucial for companies to thoroughly document the processes they follow for ESG data collection and analysis. This documentation is essential for external audits, as it allows auditors to review each step of the process and ensure that the data has been rigorously collected.

The documentation should include:

- Data collection methodologies: How and where data is obtained.

- Data sources: The databases, suppliers, or internal systems used.

- Responsibilities: Who is responsible for data collection and analysis.

- Frequency: How often data is collected and updated.

- Data limitations and uncertainties: To assess data quality and potential biases.

This level of transparency allows auditors to verify the data and ensure that it has been generated according to best practices.

5. Submit Data to External Audits

The best way to ensure that ESG data is verifiable is to submit it to external audits. Independent audits provide an objective validation of data quality and ensure that it complies with regulations.

To comply with the CSRD, companies must ensure that their ESG data can be audited by third parties. This includes working with accredited consultants and auditors who can review the data collection process and ensure it meets established standards.

Meeting CSRC requirements: keys to ensuring the verifiability of ESG reports

The CSRD requires that ESG reports be verifiable, which means they must meet certain quality characteristics:

- Accuracy: Data must be complete and reflect the true impact of the company’s operations.

- Relevance: Reports should include indicators and data that are meaningful to stakeholders and relevant to the industry context.

- Traceability: Data should be traceable to its origin, allowing verification of how it was collected and processed.

- Comparability: Data must be presented in a way that allows for comparisons with other companies and the company’s own performance over time.

Conclusion

Ensuring the verifiability of ESG data is essential for complying with regulations like the CSRD and maintaining the trust of investors and other stakeholders. Through a combination of automated systems, reliable data sources, clear indicators, and external audits, companies can ensure that their ESG data is accurate and verifiable.