The Corporate Sustainability Reporting Directive (CSRD) reshapes the sustainability reporting landscape in Europe, requiring more companies to report on their environmental, social, and governance (ESG) performance. In this guide, we break down the key steps and considerations to start implementing the CSRD, ensuring your ESG report is accurate, consistent, and valuable.

What is the CSRD, and who does it affect?

The CSRD is an EU regulation that expands the scope and obligations of the previous Non-Financial Reporting Directive (NFRD). Its goal is to improve the quality and comparability of ESG information that companies must disclose, ensuring investors and other stakeholders have access to reliable, standardized data.

Which companies are required to comply?

- From January 2024, large listed companies and parent companies of listed groups with more than 500 employees must comply.

- From January 2025, all large companies and parent companies of large groups, even if not listed, are required to report.

- From January 2026, SMEs listed on EU-regulated markets, except micro-enterprises, will need to comply, with an optional delay until January 2028.

Steps to prepare your ESG report under the CSRD

1. Understand the regulatory expectations

First, familiarize yourself with the CSRD’s requirements, including the European Sustainability Reporting Standards (ESRS), which outline what needs to be reported and how.

Key points:

- Double materiality: Consider both the financial impact of ESG factors on your company and the impact your company has on society and the environment.

- Reporting areas: Include metrics on environmental impact (CO2 emissions, resource use), social factors (gender equality, human rights), and governance (transparency, corporate ethics).

2.Data collection from internal and value chain sources

Gathering accurate data, particularly from third-party suppliers, is a major challenge. Implementing a data management system is essential for continuous monitoring of key performance indicators (KPIs).

Considerations:

- Data Collection Systems: Use software that centralizes ESG data in real time.

- Supply Chain: Ensure that suppliers align with your ESG goals and provide reliable data, especially for critical areas like carbon footprint.

3.Conduct a materiality assessment

Materiality is crucial in CSRD reporting. It means identifying which ESG issues are most relevant to your business and stakeholders. This process involves consulting internally (with management, employees) and externally (customers, investors, NGOs).

Steps for Materiality Analysis:

- Identify relevant ESG issues.

- Prioritize those with the highest financial and societal impact.

- Validate these topics with your stakeholders.

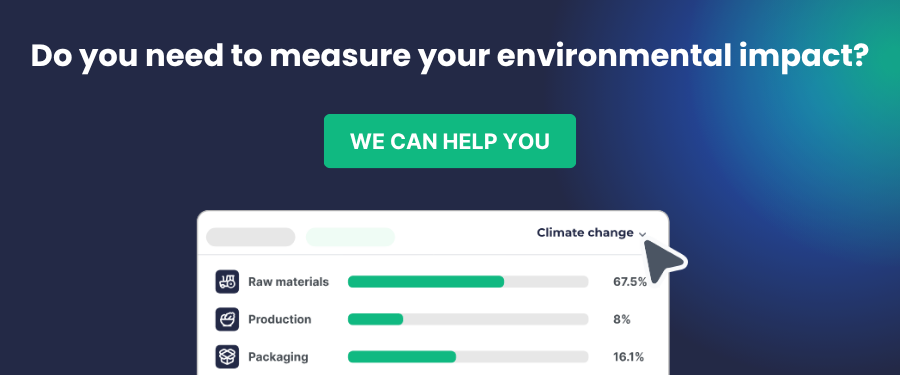

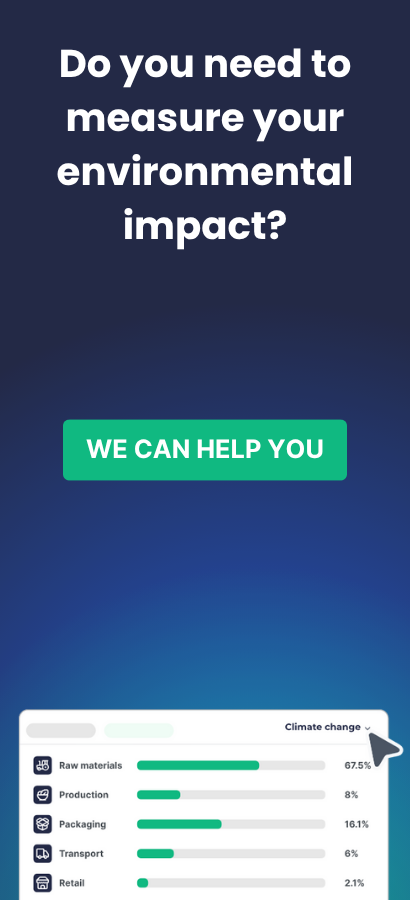

4.Measure and report key performance indicators

After identifying material topics, measure and report a set of key performance indicators (KPIs) that reflect these areas.

Examples of KPIs:

- Environmental: Greenhouse gas emissions (Scope 1, 2, and 3), energy consumption, water, and waste management.

- Social: Pay equity, labor conditions, human rights.

- Governance: Board structure, ethics policies, whistleblowing mechanisms.

Recommended Tools:

Use tools like Trazable Life Cycle for lifecycle analysis (LCA) and dedicated ESG monitoring solutions to automate calculations and reduce human error.

5.Draft the ESG Report

When writing the report, follow the structure set by the ESRS and CSRD, noting that information must now be reported in XBRL format for machine readability. Use clear, simple language, and adhere to regulatory terms to ensure data processing and comparability.

6.External Validation and Assurance

The CSRD mandates third-party verification to ensure the accuracy, traceability, and rigor of the reported information. This validation must occur annually, so selecting a reliable audit provider is essential.

7.Publishing and Communicating the Report

The ESG report should be published as part of the company’s annual report. Ensure it is accessible and easy to understand for all stakeholders. You may also provide a full version and an executive summary for broader dissemination.

Additional Tips for Proper Implementation

- Continuous Updates: The ESG regulatory landscape is ever-evolving. Ensure your team stays informed about new requirements.

- Employee Training: Invest in training to ensure all staff understand the importance of ESG reporting and can contribute effectively to its preparation.

- Avoid Greenwashing: Be transparent and clear in your reporting. Avoid exaggerating achievements or downplaying challenges.